When you become a member of NECA, you become part of a network of over 6,500 electrical and communications contractors across Australia that provides you with tools, resources and support from NECA's in-house specialist teams.

In-house Specialist Teams

All NECA members have access to phone and email support with NECA's Technical, WHS, Legal and Workplace Relations teams.

Advocacy & Policy

NECA's specialised experts dedicated to managing relationships with government and advocating for NECA member's interests at a state and federal level.

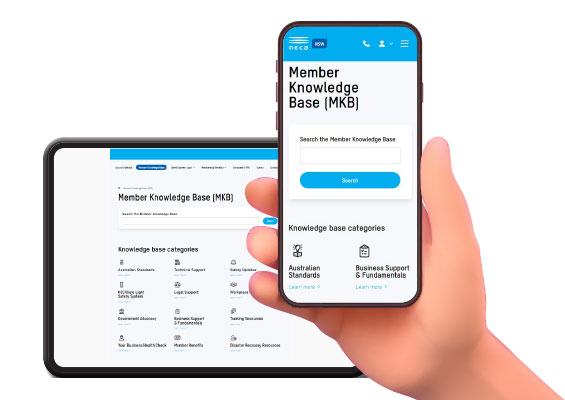

NECA's Member Knowledge Base (MKB)

An online searchable resource hub including Industry Australian Standards, HSEQ documents and SWMS, Toolbox Talks and its own Google & Apple Apps!

NECA Awards, Conference & Industry Events

NECA hosts industry events that bring member's together with leading industry experts, thought leaders, innovators & decision makers.